Irs Fsa Carryover To 2024

Irs Fsa Carryover To 2024. Fsa limits for 2024 the annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2023. The free application for federal student aid or fasfa historically opened in october but was delayed this year.

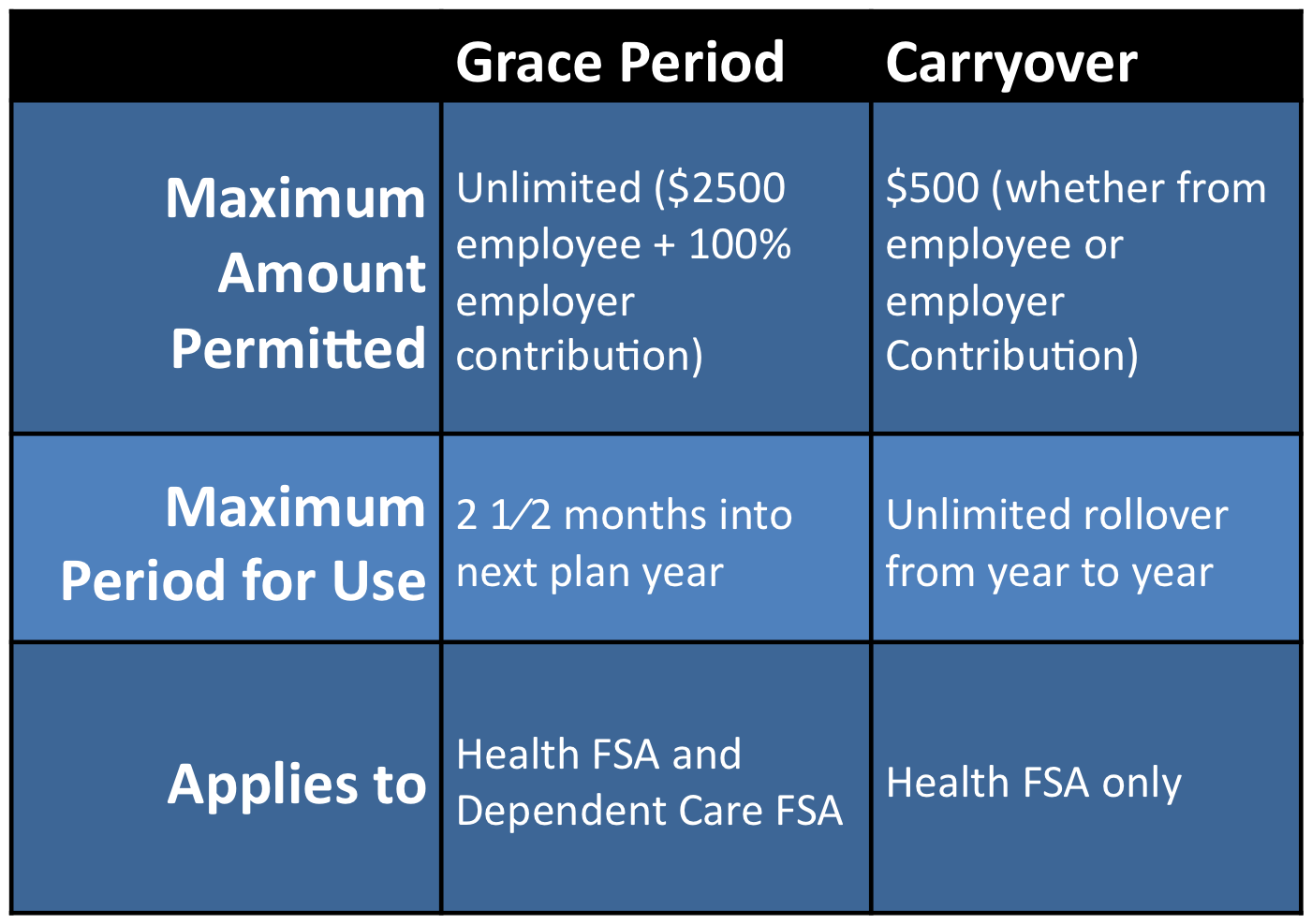

It’s important for taxpayers to annually review their. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Beginning In 2024, Employees Who Participate In An Fsa Can Contribute A Maximum Of $3,200 Through Payroll Deductions, Marking A $150 Increase From This Year’s.

If you want an fsa in 2024, you must enroll for 2024 during the open season.

For The Taxable Years Beginning In 2024, The Dollar Limitation For Employee Salary Reductions For Contributions To Health Flexible Spending Arrangements Increases To.

It’s important for taxpayers to annually review their.

But It's Important To Note That Fsa Users Will Only Be Allowed To Carry $570 Into 2023, Per The Irs's Announcement At The End Of 2021.

Images References :

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

IRS Announces 2024 Limits for Health FSA Contributions and Carryovers, Increases to $3,200 in 2024 (up $150 from $3,050. Health flexible spending accounts contribution limit:

Source: minettewted.pages.dev

Source: minettewted.pages.dev

Irs List Of Fsa Eligible Expenses 2024 Rorie Claresta, For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is. For plan years beginning in 2024, the dollar limitation for voluntary employee salary reductions for contributions to health fsas increases to $3,200 ($3,050 in 2023).

Source: imagetou.com

Source: imagetou.com

Irs Fsa Rules For 2024 Image to u, On november 9th, the irs announced additional inflation adjustments for 2024, including to the annual contribution and carryover limits for healthcare flexible. For plans that allow a.

.png) Source: koreqshelley.pages.dev

Source: koreqshelley.pages.dev

Has Irs Announced Fsa Limits For 2024 Jany Blancha, You will be able to confirm this carryover after. It's important for taxpayers to annually review their.

Source: blog.24hourflex.com

Source: blog.24hourflex.com

IRS Announces 500 Carry‐Over Provision for Health FSA Plans!, Each year the irs allows you to put a maximum amount of money into your fsa. March 1, 2021 | stephen miller, cebs.

Source: www.templateroller.com

Source: www.templateroller.com

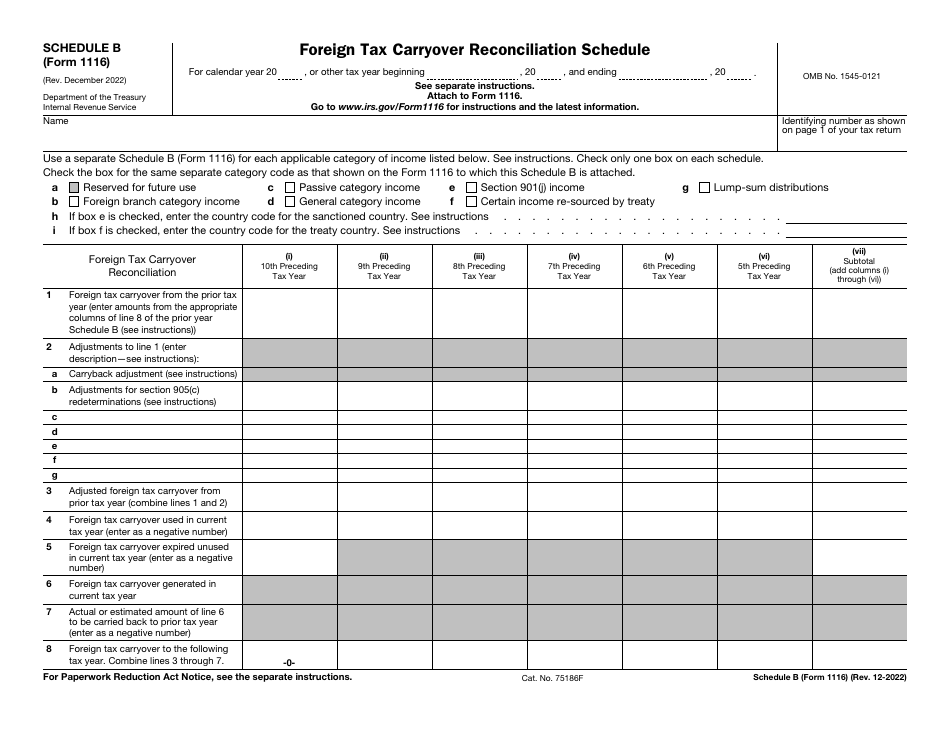

IRS Form 1116 Schedule B Download Fillable PDF or Fill Online Foreign, Your 2023 enrollment will not automatically continue into next year. For plans that allow a.

Source: imagetou.com

Source: imagetou.com

Fsa Approved Items 2024 Image to u, For plan years beginning in 2024, the dollar limitation for voluntary employee salary reductions for contributions to health fsas increases to $3,200 ($3,050 in 2023). For 2024, the maximum carryover rule is $640 in carryover funds (20% of the $3,200 maximum fsa contribution).

Source: www.alegeus.com

Source: www.alegeus.com

IRS Releases 2024 FSA Contribution Limits Alegeus, March 1, 2021 | stephen miller, cebs. Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

Source: dpath.com

Source: dpath.com

IRS Announces 2024 FSA Limits DataPath, Inc., Fsa limits for 2024 the annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2023. March 1, 2021 | stephen miller, cebs.

Source: www.differencecard.com

Source: www.differencecard.com

The IRS 2023 Cost of Living Adjustments Changes in 2023, For unused amounts in 2023, the maximum amount. By leada gore, al.com (tns) the maximum contribution amount for employees participating in a flexible spending account will increase in 2024, according to.

Beginning In 2024, Employees Who Participate In An Fsa Can Contribute A Maximum Of $3,200 Through Payroll Deductions, Marking A $150 Increase From This Year’s.

March 1, 2021 | stephen miller, cebs.

For Plans That Include The Carryover Option, That.

2024 commuter benefits contribution limits.