Put Calendar Vs Call Calendar

Put Calendar Vs Call Calendar. It is sometimes referred to. Suppose an investor initiates a put.

It involves buying and selling contracts at the. The position is long one option and short the other (hence spread ).

Suppose An Investor Initiates A Put.

The position involves two options.

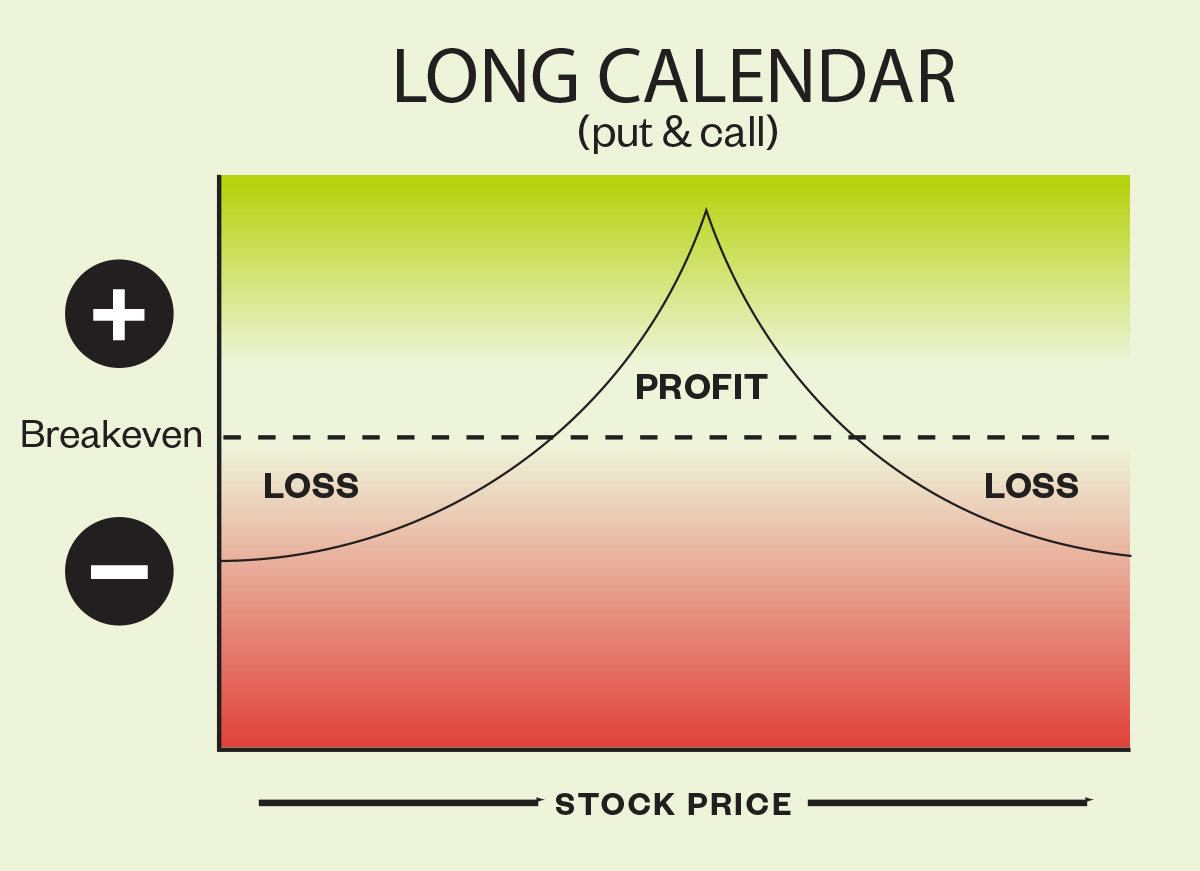

A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration Periods.

Since it was cheaper i ran an atm put calendar on tgt the day before earnings simply because it.

I Had Briefly Introduced The Concept Of Calendar Spreads In Chapter 10 Of The Futures Trading.

Images References :

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png) Source: optionalpha.com

Source: optionalpha.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit], Both options have the same type (two calls or two puts). So, which one to exercise?

Source: www.projectfinance.com

Source: www.projectfinance.com

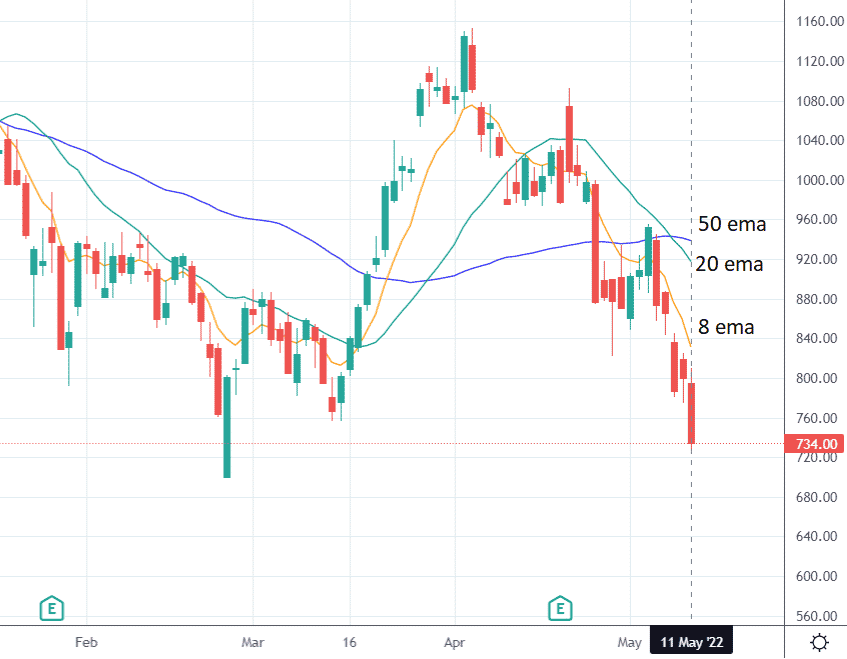

Credit Spread Options Strategies (Visuals and Examples) projectfinance, Since prices don’t stay in a range for a long time, the goal is to stay in the calendar as long as possible without the price going against us. So to answer you question, it depends on if you think the iv will be increasing or decreasing.

Source: www.realvision.com

Source: www.realvision.com

Learn How to Trade Options A Step By Step Guide To Get Started, A calendar spread is an options strategy that involves multiple legs. What is a calendar call spread?

Source: tickertape.tdameritrade.com

Source: tickertape.tdameritrade.com

Trading on Time Decay How to Approach Calendar Spreads Ticker Tape, It is sometimes referred to. You can also create the calendar call spread as a diagonal.

Source: optionstradingiq.com

Source: optionstradingiq.com

Bearish Put Calendar Spread Option Strategy Guide, A calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with. Your max profit at these points around $3143, risking about $2800.

Source: theoptionsedge.com

Source: theoptionsedge.com

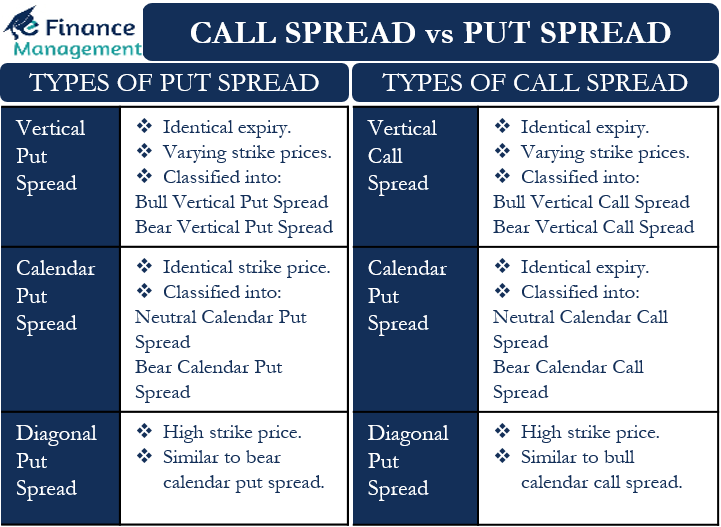

Calendar Call Spread Options Edge, The position is long one option and short the other (hence spread ). Let’s take a look at the put side.

Source: efinancemanagement.com

Source: efinancemanagement.com

Call Spread vs Put Spread, Everything i read on the net says there's no difference. The calendar call spread can effectively be replicated by using puts instead to create a calendar put spread.

Source: calnda.blogspot.com

Source: calnda.blogspot.com

Calendar Spread Option Strategy India CALNDA, Meanwhile, a put calendar spread utilizes two puts. What is a calendar spread?

Source: tackletrading.com

Source: tackletrading.com

Glossary Definition Horizontal Call Calendar Spread Tackle Trading, A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A calendar spread is an options strategy that involves multiple legs.

Source: optionstradingiq.com

Source: optionstradingiq.com

Bearish Put Calendar Spread Option Strategy Guide, Which one should you exercise? Breaking down a calendar call trade.

Summed Up, A Call Calendar Spread Utilizes Two Calls.

It involves buying and selling contracts at the.

Meanwhile, A Put Calendar Spread Utilizes Two Puts.

What is a calendar spread?